The amount that you pay into the NHS Pension Scheme has to be re-assessed on the 1st April each year and if your pay has changed over the last financial year, then your NHS Pension contributions may increase, or decrease accordingly.

The nationally agreed pay rise from the 1st April will also have to be taken into consideration in calculating your new rate of contributions. This has especially affected staff at the bottom of band 4 and those who are mid-point of band 5.

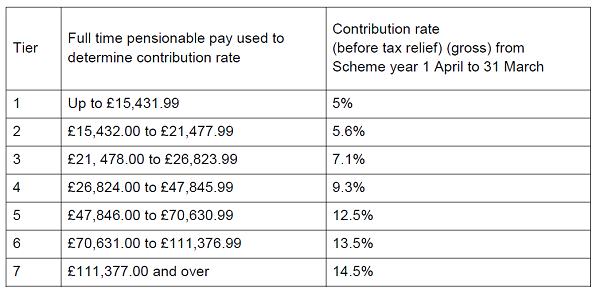

The table below shows how your contribution rate is calculated:

Please be aware that if you are part time, then your contributions will be based on what you would have earned had you been full time. Payments in respect of weekend/unsociable hours and on call allowances have to be included in this calculation. Overtime, however, is not included.

You can find out more about this by visiting the NHS Pensions website.

Published 2nd June 2020